Dan’s News & Views Blog: May-June 2018

30 May 2018

Dans News and Views Blog

Red Wing Port Authority’s Bulkhead Operation

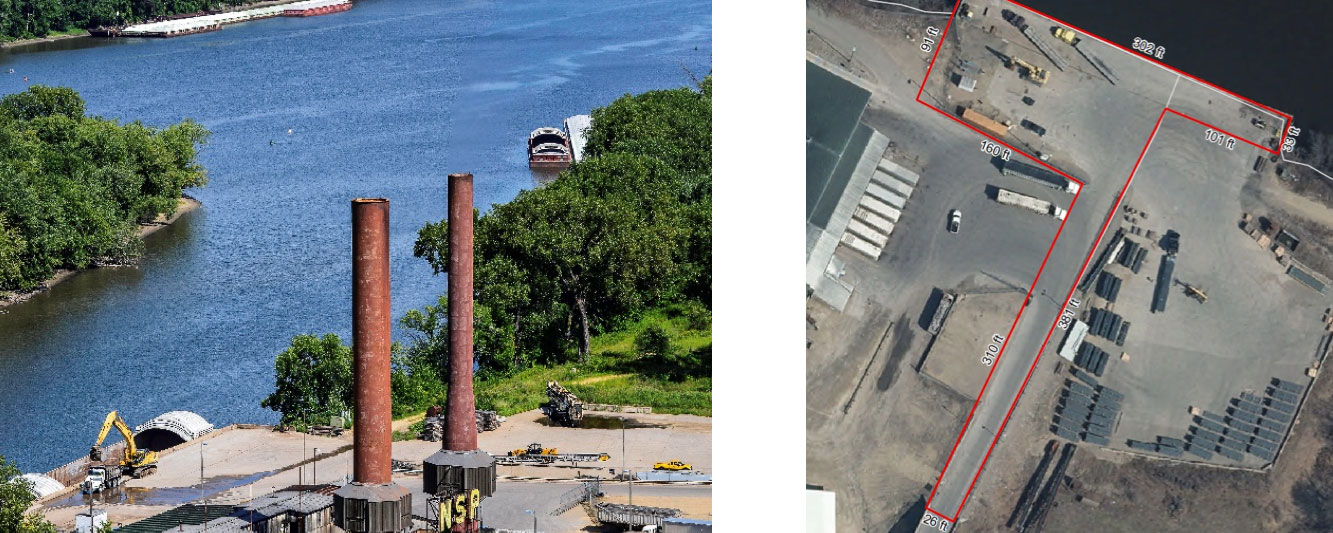

The city’s Port Authority owns property that serves as an important product transport facility along the Mississippi River. This “bulkhead” is a 300-feet wall along the river bank that allows barges to load and unload product during the open water season. The Port Authority purchased the Little River bulkhead in 1999 for $172,000 from NSP (Xcel Energy), which used it to unload coal. Once Xcel’s steam plant switched from coal to Refuse Derived Fuel, it changed its mode of transport to trucks. The Port’s ownership of this facility allowed trucks to avoid the downtown area since products were previously unloaded to Red Wing’s USG manufacturing facility at the Upper Harbor bulkheads near Bay Point Park. USG is located within two miles of the Little River bulkhead.

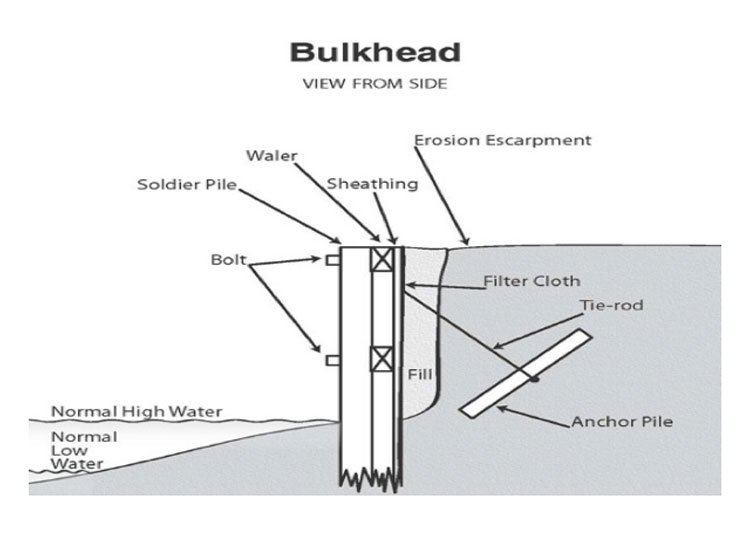

Above Left: Landfill Services unloading a barge for USG; Above Right: the bulkhead property owned by the Port Authority; Right – a diagram showing the general construction of a bulkhead.

Over the past 18 years, the Port Authority has operated the bulkhead using Landfill Services under a Bulkhead Operator Agreement. Starting in 2018, a new operator will be in place that has similar experience in Winona known as CD Terminal LLC. In addition to that agreement, the Port Authority is allowed to use the Xcel access bridge under an Operator Lease, and it uses a 2-acre storage pad next to the bulkhead under a separate lease agreement with Xcel Energy.

Over the past 18 years, the Port Authority has operated the bulkhead using Landfill Services under a Bulkhead Operator Agreement. Starting in 2018, a new operator will be in place that has similar experience in Winona known as CD Terminal LLC. In addition to that agreement, the Port Authority is allowed to use the Xcel access bridge under an Operator Lease, and it uses a 2-acre storage pad next to the bulkhead under a separate lease agreement with Xcel Energy.

In 1999/2000, the Port Authority spent $650,000 to improve the structural integrity of the bulkhead, 80% of that cost coming from the Minnesota Port Development Assistance Program.

Red Wing’s Market Value

The League of Minnesota Cities annually publishes the total property market value of all cities. Red Wing’s total market value increased from $1.897 billion in 2016 to $2.041 in 2017, an increase of 7.6%. As a comparison, Faribault’s total 2017 market value was $1.175 billion, and Northfield’s value was $1.239 billion. Red Wing’s percent of total market value for commercial and industrial property was 54.1%, which compares to an average of 23.2% for all Greater Minnesota cities. Future market value increases are likely due to new development in Red Wing, such as the new downtown Associated Bank building under construction this year (shown above).

The League of Minnesota Cities annually publishes the total property market value of all cities. Red Wing’s total market value increased from $1.897 billion in 2016 to $2.041 in 2017, an increase of 7.6%. As a comparison, Faribault’s total 2017 market value was $1.175 billion, and Northfield’s value was $1.239 billion. Red Wing’s percent of total market value for commercial and industrial property was 54.1%, which compares to an average of 23.2% for all Greater Minnesota cities. Future market value increases are likely due to new development in Red Wing, such as the new downtown Associated Bank building under construction this year (shown above).

Tax Increment Financing

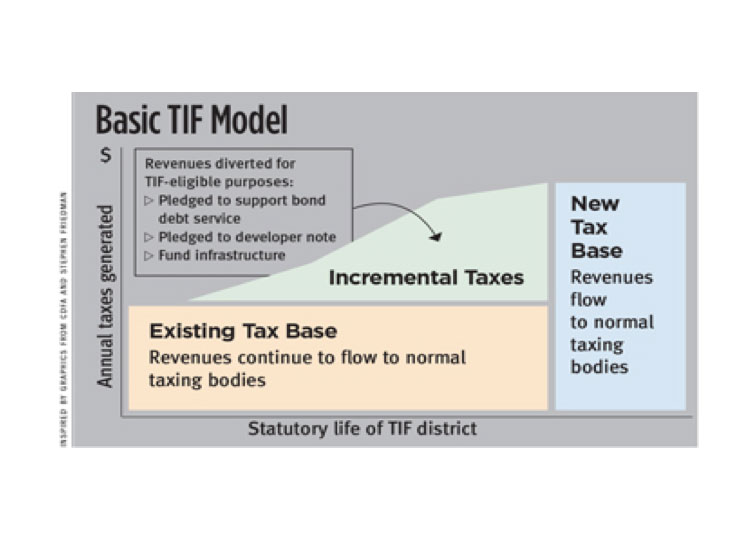

The City of Red Wing has one active Tax Increment Financing (TIF) District that was previously approved for the Target redevelopment project. A new TIF application is currently under review by the City Council for a proposed housing development that would include 40% of the units as affordable. Of the 250 proposed rental units, 100 would be available to households with income levels at/below 60% of the area median income. Here are some TIF basics:

The City of Red Wing has one active Tax Increment Financing (TIF) District that was previously approved for the Target redevelopment project. A new TIF application is currently under review by the City Council for a proposed housing development that would include 40% of the units as affordable. Of the 250 proposed rental units, 100 would be available to households with income levels at/below 60% of the area median income. Here are some TIF basics:

- Increased property taxes, as a result of new real estate development, are captured for a set number of years by a local unit of government; the existing tax base before development is not captured.

- That tax increase is used to finance costs associated with a new development project, such as property acquisition, site preparation, and private or public infrastructure.

- Five types of TIF Districts include: (1) Redevelopment, (2) Renewal and Renovation, (3) Economic Development, (4) Housing, and (5) Soils.

- TIF that supports affordable housing must result in affordable rents to households with set maximum annual income levels.

- The common form of assistance to private developers is called “pay-as-you-go”, which results in no debt obligation of the city, nor any risk to the city if taxes should be lower than expected. The developer pays all cost up front, and then gets reimbursed from TIF proceeds over time.

- Once the TIF term is done, all base and increased taxes go to the various taxing jurisdictions.

Less than 1.0% of Red Wing’s total taxable value is captured in its single TIF District (0.7%), which compares to a statewide average of 3.7%. A 2017 TIF Legislative Report shows that of all TIF revenue generated in the state during 2015, nearly 17% came from Greater Minnesota, and 83% came from the Metro Area. The total TIF revenue generated in Greater Minnesota in 2015 ($32.67 million) came primarily from Redevelopment Districts (52%), followed by Housing (28%) and Economic Development Districts (19%).

Dan Rogness

Red Wing Community Development Director

More Topics